Why There Won’t Be A V- Shaped Recovery This Time

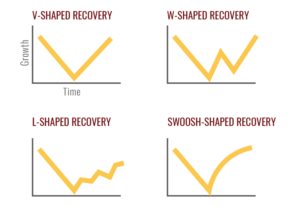

Stock indices & economies can take different times to recover depending upon the cause of the falls. Hence we need to be bit cautious with respect to our expectations of recovery after every fall.

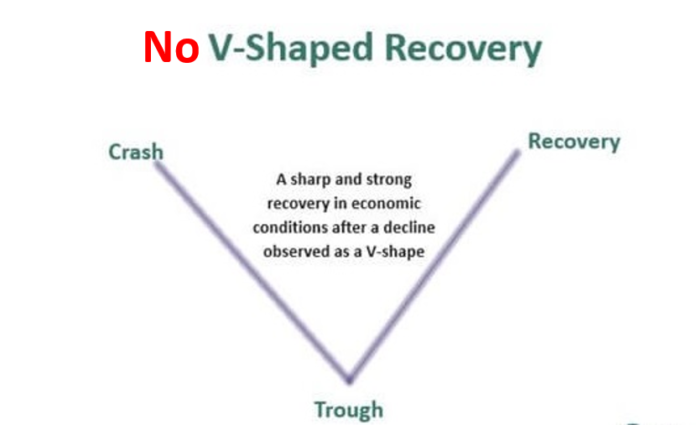

Indices recovered quickly known as a V-shape-recovery after the falls of COVID, Demonetization and Kargill wars – but can we expect the same this time .

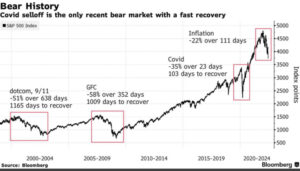

You all would agree that those were black swan events – not discounted by the market in advance – very sudden events .So market recovered very fast as soon as it realized the extent of damage by those events .

But this time – the fall is not out of sudden events – every future news is being discounted now – fall has been slow ( Oct onwards ) – so recovery would also be slow .

We can see a clear distribution pattern from October itself as well as FIIs were selling for last full year .

(In hindsight, that was a clear sign for this ongoing fall as currencies were falling all around the globe but India and few other countries were holding . But FIIs understood that and they cound see that we can no longer save our currency in wake of going against the global trend. They sold Indian and other emerging markets equities even before the real currency-depreciation started)

In a real bear market, there is no capitualation (sudden fall). The fall comes in waves with few recoveries (counter trend bounces ) in between . Bear markets are unlike the corrections that happen in bull markets where markets start moving up after going down a bit.

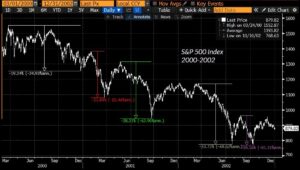

Here are few examples of bear markes falls from US markets in different periods.

Bear -markets generally happen to be of 12-18 months duration in India – 6 months already gone – let’s hope we recover in 1st half of next year ( unless US crashes very badly ) And yes, let’s also keep a watch on our currency, more it falls ,more bad it would be for equities.

Here’s the historical presepective ( last 25 years ) from one of the world’s mature indexes.

Recoveries are slow if equity prices go down slowly in a grinding way. That is the result of structural shift in underlying global-macro factors i.e. economy, liquidity , bubbles in certain pockets etc.

These all views are just opinions – forecasting is not so easy.

7 claps

Thanks for guidance sir. Helps a lot on current situation. Let’s hope we recover next year 🙂