Should you buy the dip? The phrase “buy the dip” means jumping into the stock market when it is falling, hoping to scoop up some low-priced stocks for longer term profits.

This habit becomes more pronounced among newbie investors especially in a bull-run when one buys certain stocks when prices go down . In a bull -run , prices start their upward journey again afer a small-pause or correction.

But is it always a good strategy to buy the dip?

Well it might prove profitable in a bull run but it can be highly counter-productive when there is revesal in the bigger trend . Dip starts getting deeper and investors need to hold the stocks for a very long period of time for the stock -prices to recover 9 and in many case the old prices never come)

There are times when investors should start playing the opposite i.e. “selling the rip’, sell-on-rise” selling into a short-term move higher in stocks?

In short, in every market there is a time to buy-the-dip ( when the prices correct ) and there’s a time to wait or sell when prices are rising. There is a time to start the SIP and there is a time to stop your SIP and book your profits.

Understanding the difference between buy-the-dip vs sell-the -rip timings can help an individual to make more money as well as to keep the hard-earned profits safe.

Buying- the-dip or doing SIP at wrong time, in wrong phase of the market can lead to big losses wrt money, time and energy. Whereas waiting and sitting out can be very helpful for long-term investor if he/she is able to deploy the funds at the right time.

Let’s try understand by comprehending the bigger picture on when one should be -buying -the-dip (SIP ) , when one should be selling-on rise and when to wait and sit-out of the markets .

For this ,we need to have a clarity about the larger phases of the markets.

Market Cycles.

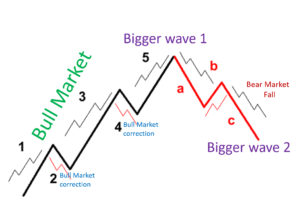

There’s a theory named Elliot Waves . As per this theory , every market moves in cycles and there are waves in-between.Every big upside/dowside wave has 5 waves with -in (fractals)

Once the 5 waves get completed in a trend (up/down), the trend on the other side begins.

Similarly there’s another study named Dow Theory.

The Dow theory is an approach to trading developed by Charles H. Dow.

As per this , there are different phases in the market as following:

The practitioner of these theories try to find out when 5 waves are complete or to identify the distribution phase.

The study is based on counting the waves as well as looking at volume/price actions to understand accumulation/distribution phases. This analysis is combined with macro-environment and economic cycles .

Many a times , economic down-cycle and bear market overlaps and many a times there is time -lag as market works as a robust future -discounting mechanism.

Because when one sided 5 waves move is over or accumulation phase is over, the bigger bear market (correction in the prices ) starts that can last for months and years.

Till the time, you are in one side upward going 5 waves or in accumulation phases , buy-the -dip makes sense. But when the 5 waves get over or accumulation phase ends, it is the time either to sell or wait till the time next upmove cycle starts.

When to start buying ?

If you’re in a bull market ie. when market is trnding up, one can buy the dip at every bull market correction. One can learn one of the three methods – Eelliot Waves, Dow Theory or Stage Based Investing.

But in a bear market ,one needs to wait and sit out. Wait for the nest uptrend to begin and then jump-in at the right time.

That means that one needs to be astute enough to understand whether the market is doing correcion where overall trend is still bullish ( 5 waves uptrend or accumulation phase ) or it is getting into distribution phase. If the trend is still bullish, buying-the-dip makes sense but if the market has entered in long bear phase, it is wise to wait.

In bear marekts,one can keep an eye on macro , as soon as some green shoots of recovery are seen in the economy. At the same time, one can learn Elliot or Dow theory to understand whether the fall has stopped and bottom has been made.

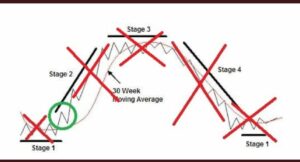

Apart from that, there ais another method, popularised by Stan Wienstein. It is known as Stages-Based-Investing model . And this model helps in the identifying different phases of the market ( or a stock) in a very manner.

To learn more about this method, you can click here.

Buy High , Sell Higher

Stage Investing, Dow theory as well as Elliot wave theory are quite in contrast of popular- market myth named ‘buy-low-sell-high’. Rather veteran investors wait for the prices to start moving up and when trend becomes favorable . This strategy is also known as ‘buy-high,sell-high’.

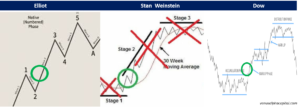

Look at the following picture carefully. This gives a bird’s eyeview of buying -timing as per all three theories mentioned above.

The green circles indicate the buying timing . None of these three experienced and successful investors suggest to buy at the lowest price ( rarely anyone can catch the bottom price) .

As per Elliot, one should buy when wave 3 starts, as per Stan , one should buy when the price closes above 30 weeks moving average ( there are bit more nuances to it) and Mr. Dow suggests to buy when the accumulation phase is over ( when market and stock-price starts making higher -highs and higher-lows).

There are sevral advantages of understanding any of these theories e.g. one would buy only when the market and stock prices are going up , one would enter the market when bg fund -houses are entering the market and they have made the bottom , and this would also be the time when all desperate sellers have given up on the market by getting frustrated by lower or no price movement in the stock.

If you play the strategy right, you can take advantage of what’s called reversion to the mean. The idea here is that by buying stocks after they’ve fallen, you can ride them to higher long-term gains as they re-accelerate to their long-run average gains, that is, revert to their mean return.

6 claps