C Wave -Ideal Time for Bargain Hunters

Hope many of our readers enjoyed the recent bear market rally ( yes we believe that we’re in a bear market and recent rally was just a pull-back , a bounce in B wave )

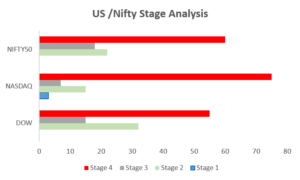

And now it seems that we’re on the verge of starting a C wave on all global major stock-indices.

The reasons are obvious :

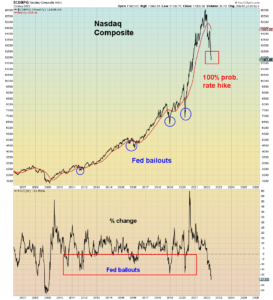

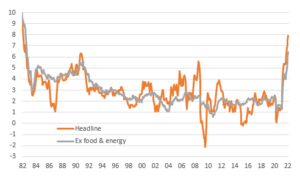

-Increasing inflation

-Falling dollar ,affceting glabal level debt and repayment capabilities

-Fed increasing interest rates , rising bond yields, falling bond prices

-Depleting liquidity

-Ukraine war

Seems to be a perfect situation for the start of a C wave in equity-markets.

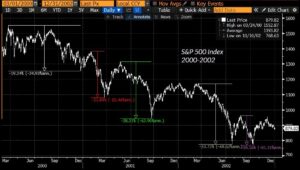

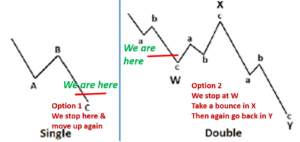

Types of Big Falls !

Before we deep dive into more details about imminent C wave , let’s understand the 2 types of big falls in finanacial markets .

The big falls happen due to two reasons :

1. Macro-factors

2. Black-swan events (sudden, unpredicatable)

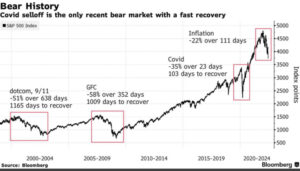

The fall due to black swan events is sudden and ferocious- as these are sudden events ,market has not discounted these factors , it gets a shock and try to make sense out of this suddenness.

In black swan events, big market players first immediately try to come out to comprehend the impact of the black- swan event , after understanding it they discount it & come back to the markets.That’s why recoveries are fast ( Kargill,Demonetozation,Covid etc)

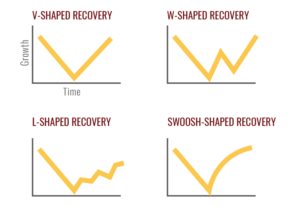

Here the fall is very quick but recovery is also fast (know as V shaped recovery) .

But it is not the case wrt the fall related to macro factors .

These are underlying invisible factors , not easy for a common investor to understand as these are not felt by 5 senses . And macro involves lot of interelated events that are not easy to comprehend in advance.

Initial fall related to macro factors is slow and grinding – with lots of ups and downs.Informed investors (hedge funds, pension funds, FIIs,DIIs ) sense it early & they sell at the beginning.But small and uninformed investors still keep on buying the dip as market keeps them rewarding . Big investors don’t liquidate their positions in a rush. They keep the markets attractive for small and uninformed investors to sell their own stocks at higher prices.This phase is called distribution phase where big-money distributes their holdings slowly-slowly .Once they have liquidated most of their holdings then they have no interest to keep the prices high and then th prices plunge ferociously.

It is like termite,initial damage is not visible but the tree falls suddenly after a while.

C waves come in both type of falls – it is slow and grinding initially in macros-related fall and catches up the speed in later phase but in black-swan-events related fall , it is sudden and very fast.

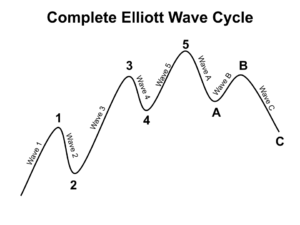

What Is C wave ?

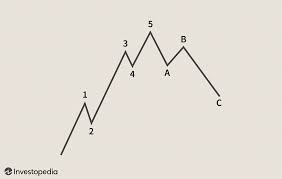

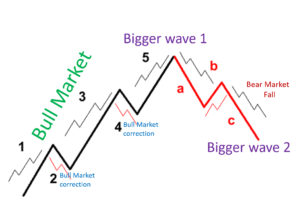

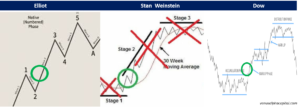

Well there is a theory named Elliot Waves. This theory in technical analysis used to describe price movements in the financial market. As per this , price of every thing ( whereever there’re masses involved ) moves up in 5 waves (1,2,3,4,5) and then come down in 3 waves (A,B,C). The following picture can give you more clarity.

In C wave , the prices fall very sharply as well as can go very deep. In theory, wave C should be equal to wave A i.e. the fall in C should be equal A. But in real practice, many times wave C ends early or can become much bigger than wave A.This is difficult to predict in advance.

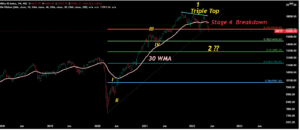

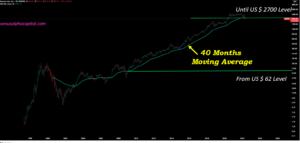

You might like to look at the follwing Nifty 50 chart of last 30 years and can see how C waves work !

Keep in mind, C waves keep coming on all time frames- hourly , daily, monthly ,yearly etc etc.

Bigger the time frame-bigger the impact. Here we’re refering to a C wave on larger time frame i.e. monthly.

In the above picture, one can easily find that C waves were brutal during every major global crisis. Are we going through similar crisis ? Well only time would tell!

Are We Sure That Wave C is coming ?

Well no one can be sure of anything – future is uncertain ! One can just work on probabilities , like we do in very sphere of life knowingly or unknowingly.

Food for Thought

There are two kinds of forecasters: those who don’t know, and those who don’t know they don’t know – John Kenneth Galbraith

So we’re tyring to forecast here by clearly knowing that we don’t know. Many of the Elliot practioners belive that , we might be entering the C wave on most of the global indices.

How To Play Wave C ?

Well for long term investors, it is an ideal period for bargain hunting . One needs to wait patiently and let the prices settle down and pick the underpriced businesses at bargain prices.

One can get the prices on one extreme of pendulum . In short ,C wave is an ideal time for long term investors and bargain hunters.

( Hope you know about pendulum theory ? Pendulum theory says that when stocks head downward after a period of overvaluation, they won’t stop at fair value. Instead, they’ll keep dropping until they hit lows that are in some sense as out of whack as previous highs, or close to it. )

And it is a waiting game , just like fishing . Market demands lots of patience to give handsome rewards .Wait can be for weeks and months with lot of tempting-periods known as FOMO in beteween .

Traders look for shorting opportunities in wave C.

What Bargains We’re Looking For ?

Well we beilve that if Indian economy has to do well , old economy stocks should perform well ( as for those to perform we don’t need to look towards West or rest of the global economy where we find lot of trouble points and that may last longer than expectations)

And becuase we believe in doing technical analysis apart from looking at the fundamentals of business , recent multi-decadal break-outs in several sectors somehow supports our theory on old-economy stocks.

Also as per our experience, once a cycle of a sector turns , it can last 5-10 years.

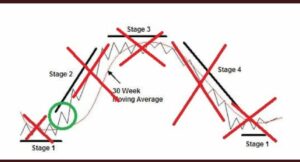

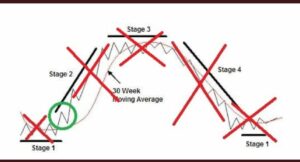

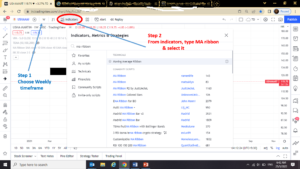

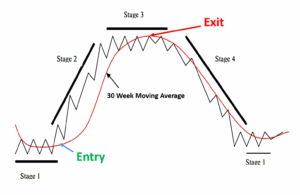

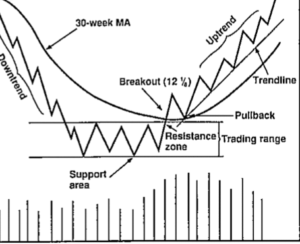

But don’t hurry at all. There are no V shape recoveries in these kind of macro-factors related falls.They linger on for weeks and months. Better to watchout from distance . Once the next bull run starts , you will have ample time to enter – buy high ,sell high is better strategy than buying every dip when you don’t know the bottom – a newbie can follow Stage Analysis method .

In coming months, in this C wave ,we would be hunting for bragains in following sectors :

Power –a breakout after 13 years

Capital Goods – a breakout after 13 years

Realty – A breakout after 2009

In summary : Our assumptions are

a) C wave is about to start ( or it has already started)

b) We might get good bargains once C wave is baout to complete

c) Old economy related stocks gave their first leg of rally in last 2 years ( wave 1) and now they also might give correction (wave 2) alongwith rest of the market .

d) Wait patiently and start buiding positions as per Stage Analysis method.

e) Keep in mind that C waves are also not in straight line, they can have different structures .One of the simplest structure is ABC , that is with in C wave , you fall in A wave , bounce back in B wave and again fall in C wave.

Disclaimer : Above thoughts are just views, may or may not play out.

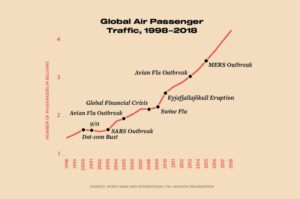

Decrease in air-passengers traffic after the 9/11 event is another example of regency bias .

Decrease in air-passengers traffic after the 9/11 event is another example of regency bias .